Case Study

Case Study

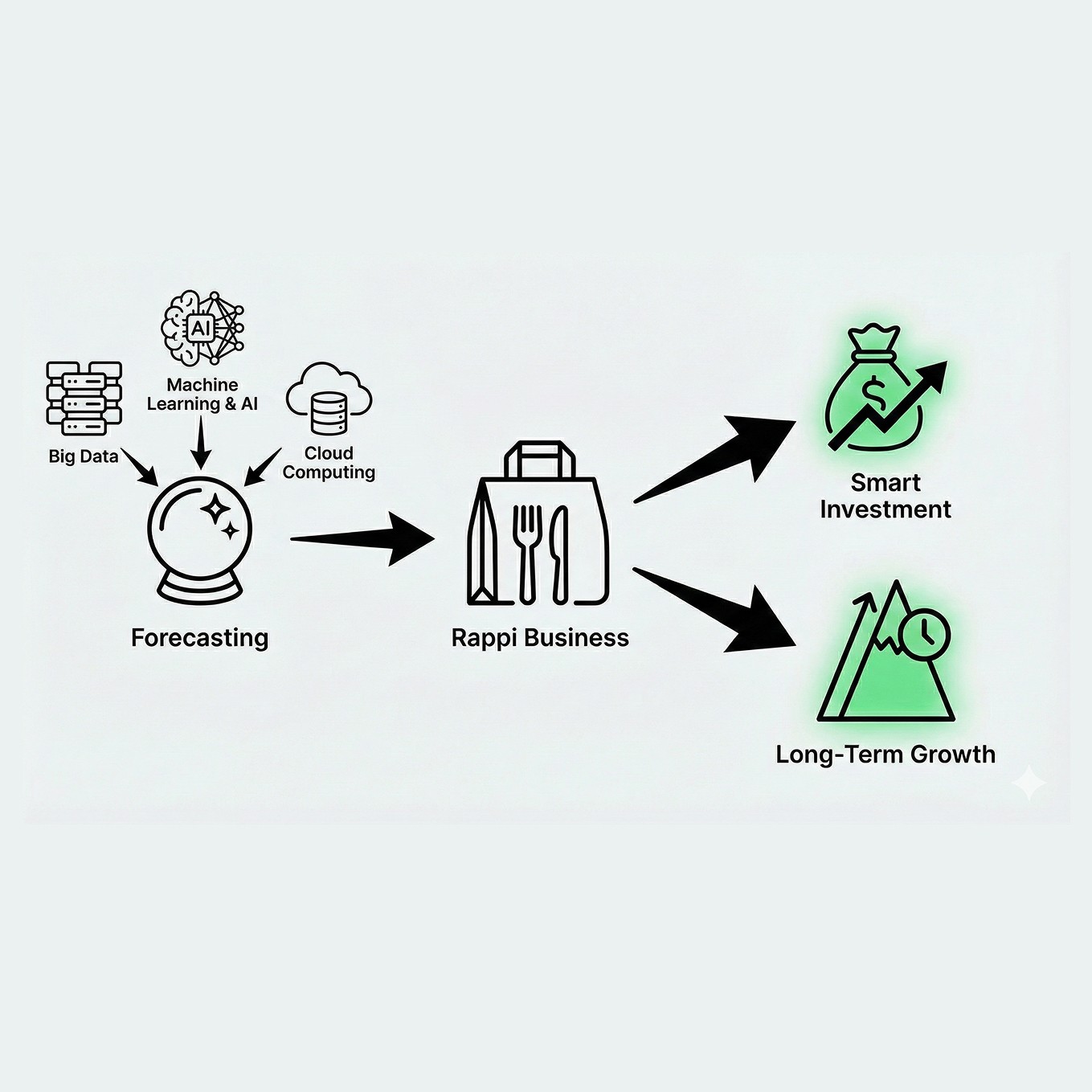

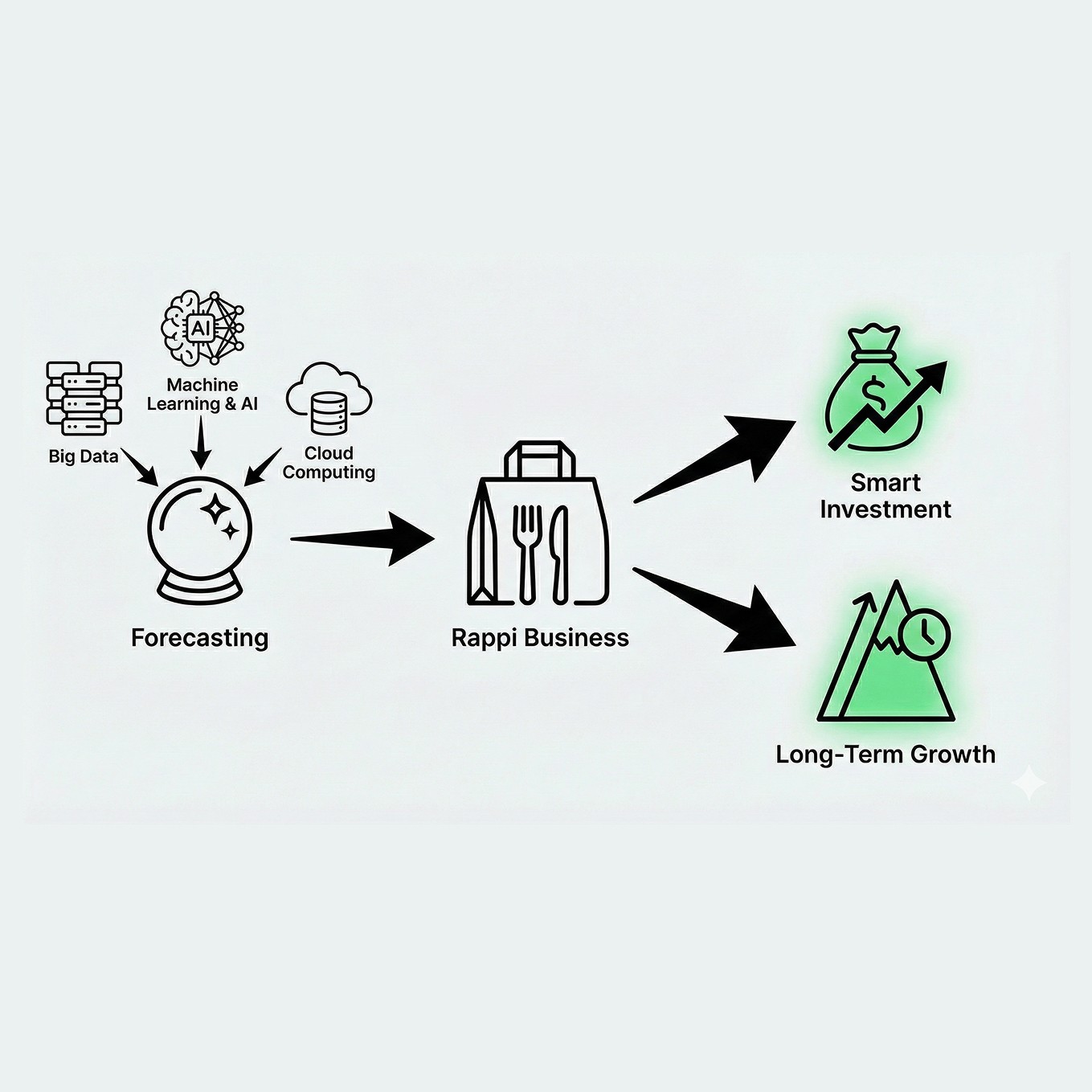

Rappi: Using Data to Invest Smarter and Grow Without Losing Control

Company

Rappi

Company

Rappi

Company

Rappi

Services

Growth Enablement · Marketplace Liquidity · Cost Efficiency · Supply Scalability · Real-Time Execution · Data-Driven Decision Making

Services

Growth Enablement · Marketplace Liquidity · Cost Efficiency · Supply Scalability · Real-Time Execution · Data-Driven Decision Making

Services

Growth Enablement · Marketplace Liquidity · Cost Efficiency · Supply Scalability · Real-Time Execution · Data-Driven Decision Making

Industry

Logistics & Marketplace Operations

Industry

Logistics & Marketplace Operations

Industry

Logistics & Marketplace Operations

Year

2025

Year

2025

Year

2025

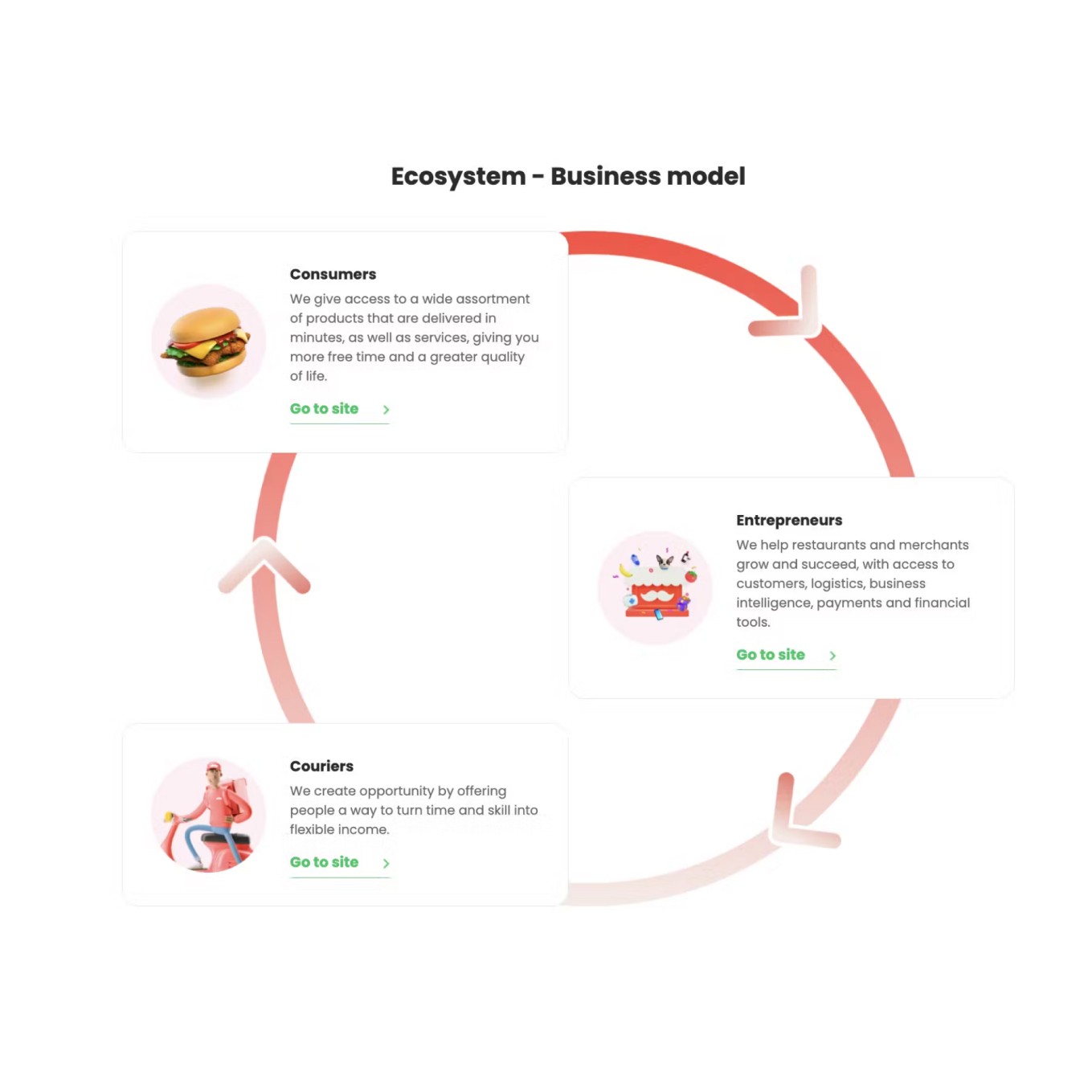

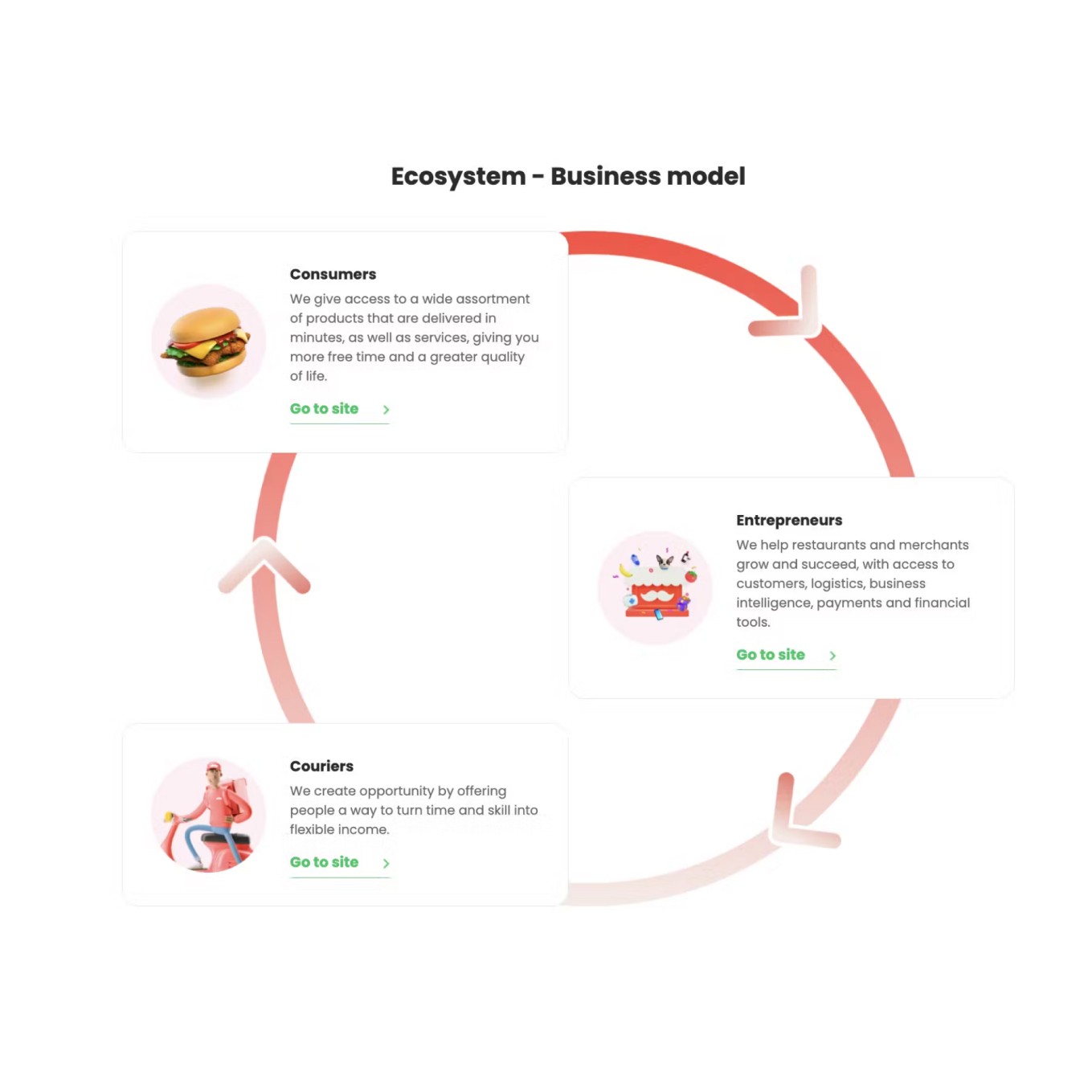

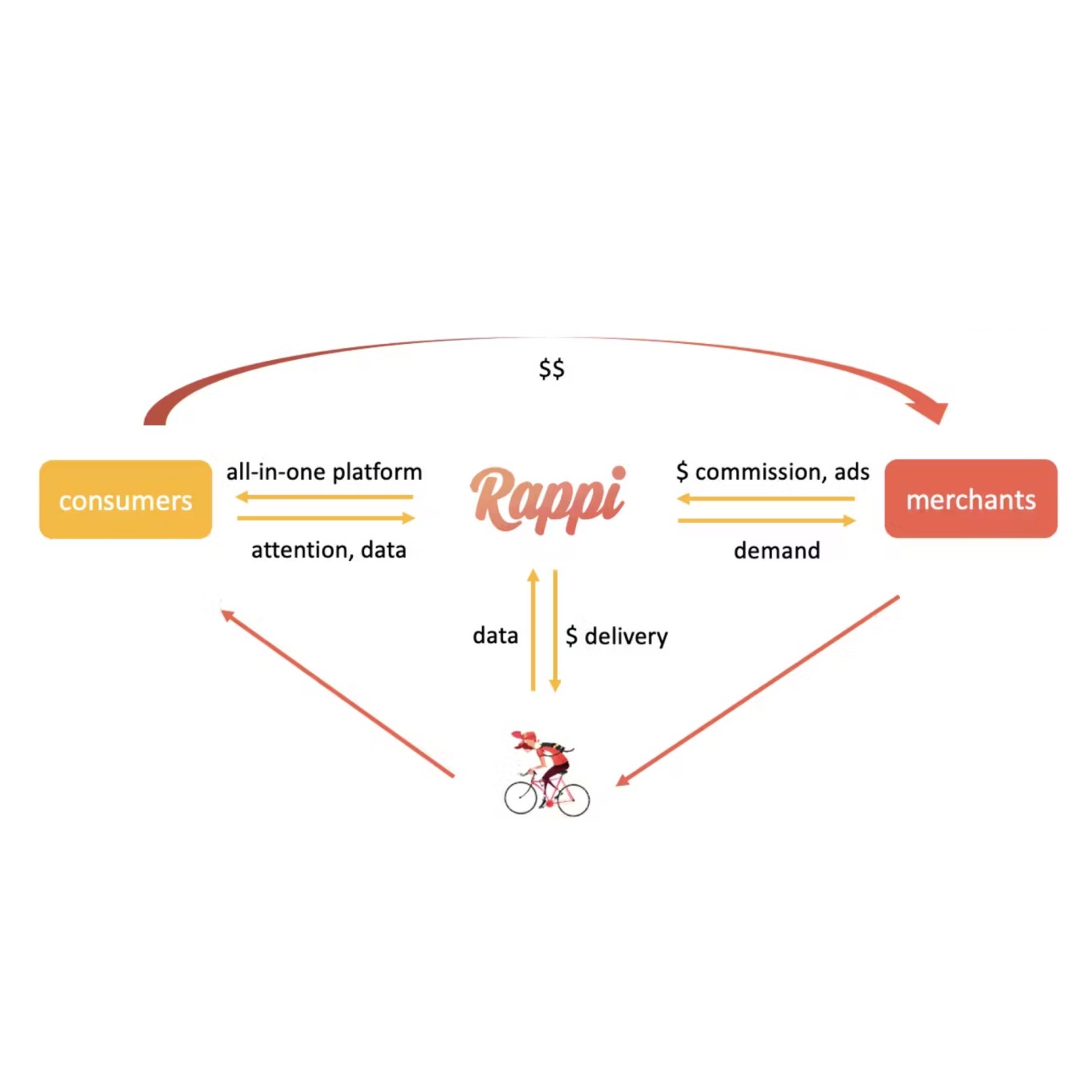

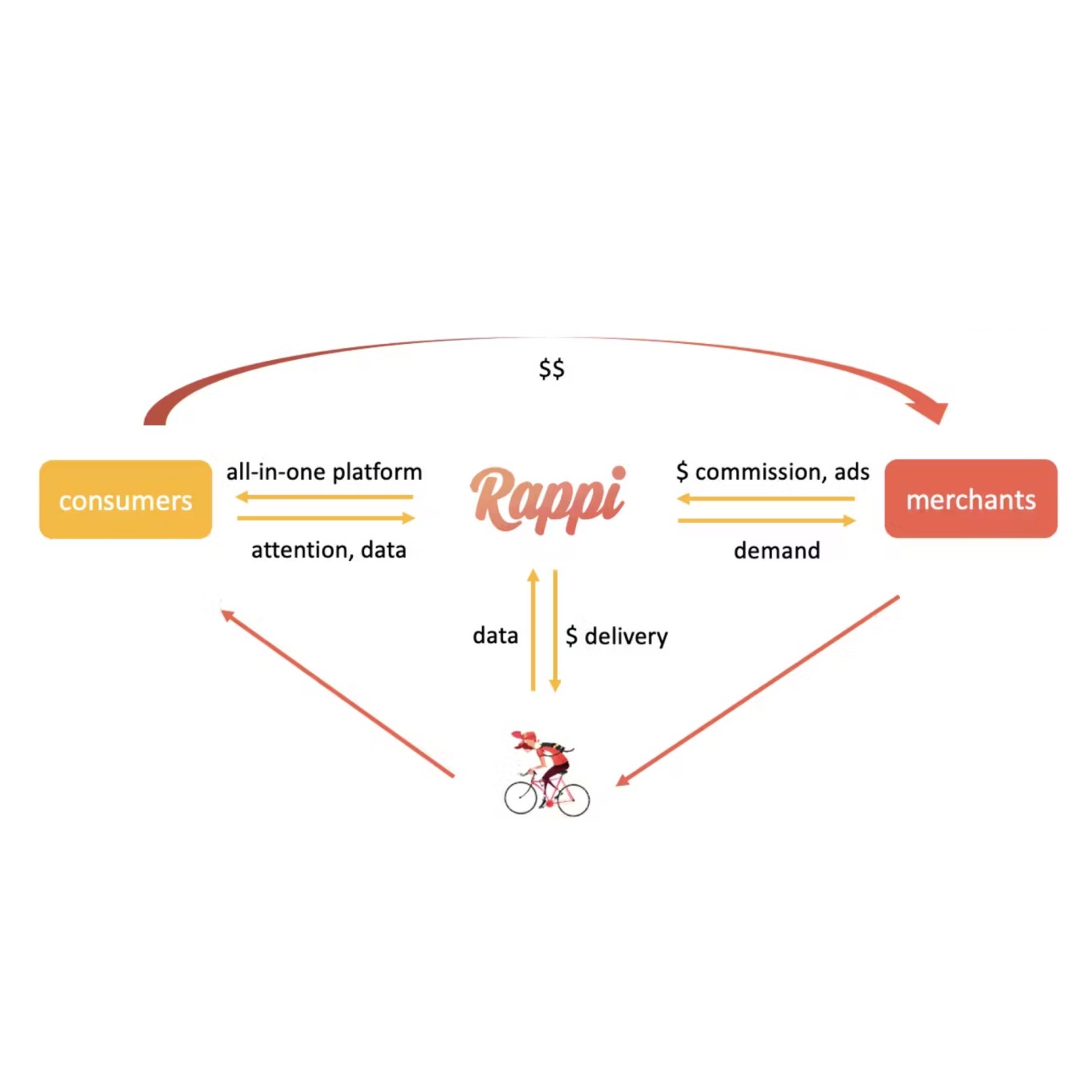

Rappi is the largest unicorn in Latin America, valued at over $5B, operating across 9 countries and 200+ cities. As the business scaled, one of its most critical challenges became clear: how to allocate resources efficiently on days with demand spikes or supply shortages—without overspending or losing control of operations. Poor investment decisions during high-variability days could directly impact: revenue service quality customer experience long-term growth The opportunity was to move from reactive decision-making to a structured, data-driven investment system—capable of guiding both short- and long-term decisions at scale.

Simon Borrero

CEO & Founder

We’ve reached a scaling phase where the model has proven to work. It creates strong social impact—benefiting couriers, merchants, and users by giving them back valuable time to enjoy with their families. At the same time, it’s a model that also works financially.

The challenges

Building a forecasting and investment system capable of supporting decisions across 200+ cities in multiple countries is a complex task. The main challenges included:

Seasonality and holidays: Demand patterns vary significantly by country and city, requiring a scalable and localized forecasting approach.

Inorganic growth impact: Marketing campaigns drive demand spikes that must be measured and incorporated into forecasts accurately.

Capital allocation efficiency: Supply and marketing investments are costly—overestimating leads to waste, underestimating leads to lost sales.

Value capture through process: Forecasts alone are not enough; they must be embedded into daily operational decision-making to generate real impact

The approach

A tailored process was designed and executed across four phases.

A tailored, data-driven process was designed and executed across four phases.

Phase 1: Short-Term Forecasting for Immediate Investment Decisions

The first priority was improving short-term investment accuracy.

Working with a team of data scientists, a forecasting system was developed to predict city-level demand up to 7 days ahead, achieving 94% accuracy across Latin America.

This enabled teams to:

anticipate demand surges

allocate supply more precisely

make informed short-term investment decisions

Phase 2: Process Integration, Measurement, and Continuous Improvement

Forecast outputs were integrated into operational workflows.

Whenever demand deviated from business-as-usual patterns, the system triggered structured decision processes—allowing multiple teams to respond quickly and consistently.

This shift from intuition-based to process-driven execution led to measurable improvements in investment effectiveness.

Phase 3: Long-Term Forecasting for Strategic Planning

Once short-term stability was achieved, the focus shifted to long-term planning. Advanced machine learning and AI models were introduced to forecast demand variability 3 to 12 months ahead—enabling long-term investments that are typically difficult to predict.

This allowed Rappi to:

plan capacity and incentives in advance

reduce volatility risk

support sustainable, year-over-year growth

Phase 4: Process Optimization and Long-Term Value Capture

The forecasting system became a core input for multiple strategic initiatives, including:

payments

marketing investments

non-monetary incentives

strategic partnerships

The model was also implemented in the 2025 Rappi–Amazon alliance, ensuring investment decisions were aligned across short- and long-term horizons.

The expected annual impact exceeds $60M in value capture.

The challenges

Building a forecasting and investment system capable of supporting decisions across 200+ cities in multiple countries is a complex task. The main challenges included:

Seasonality and holidays: Demand patterns vary significantly by country and city, requiring a scalable and localized forecasting approach.

Inorganic growth impact: Marketing campaigns drive demand spikes that must be measured and incorporated into forecasts accurately.

Capital allocation efficiency: Supply and marketing investments are costly—overestimating leads to waste, underestimating leads to lost sales.

Value capture through process: Forecasts alone are not enough; they must be embedded into daily operational decision-making to generate real impact

The approach

A tailored process was designed and executed across four phases.

A tailored, data-driven process was designed and executed across four phases.

Phase 1: Short-Term Forecasting for Immediate Investment Decisions

The first priority was improving short-term investment accuracy.

Working with a team of data scientists, a forecasting system was developed to predict city-level demand up to 7 days ahead, achieving 94% accuracy across Latin America.

This enabled teams to:

anticipate demand surges

allocate supply more precisely

make informed short-term investment decisions

Phase 2: Process Integration, Measurement, and Continuous Improvement

Forecast outputs were integrated into operational workflows.

Whenever demand deviated from business-as-usual patterns, the system triggered structured decision processes—allowing multiple teams to respond quickly and consistently.

This shift from intuition-based to process-driven execution led to measurable improvements in investment effectiveness.

Phase 3: Long-Term Forecasting for Strategic Planning

Once short-term stability was achieved, the focus shifted to long-term planning. Advanced machine learning and AI models were introduced to forecast demand variability 3 to 12 months ahead—enabling long-term investments that are typically difficult to predict.

This allowed Rappi to:

plan capacity and incentives in advance

reduce volatility risk

support sustainable, year-over-year growth

Phase 4: Process Optimization and Long-Term Value Capture

The forecasting system became a core input for multiple strategic initiatives, including:

payments

marketing investments

non-monetary incentives

strategic partnerships

The model was also implemented in the 2025 Rappi–Amazon alliance, ensuring investment decisions were aligned across short- and long-term horizons.

The expected annual impact exceeds $60M in value capture.

The challenges

Building a forecasting and investment system capable of supporting decisions across 200+ cities in multiple countries is a complex task. The main challenges included:

Seasonality and holidays: Demand patterns vary significantly by country and city, requiring a scalable and localized forecasting approach.

Inorganic growth impact: Marketing campaigns drive demand spikes that must be measured and incorporated into forecasts accurately.

Capital allocation efficiency: Supply and marketing investments are costly—overestimating leads to waste, underestimating leads to lost sales.

Value capture through process: Forecasts alone are not enough; they must be embedded into daily operational decision-making to generate real impact

The approach

A tailored process was designed and executed across four phases.

A tailored, data-driven process was designed and executed across four phases.

Phase 1: Short-Term Forecasting for Immediate Investment Decisions

The first priority was improving short-term investment accuracy.

Working with a team of data scientists, a forecasting system was developed to predict city-level demand up to 7 days ahead, achieving 94% accuracy across Latin America.

This enabled teams to:

anticipate demand surges

allocate supply more precisely

make informed short-term investment decisions

Phase 2: Process Integration, Measurement, and Continuous Improvement

Forecast outputs were integrated into operational workflows.

Whenever demand deviated from business-as-usual patterns, the system triggered structured decision processes—allowing multiple teams to respond quickly and consistently.

This shift from intuition-based to process-driven execution led to measurable improvements in investment effectiveness.

Phase 3: Long-Term Forecasting for Strategic Planning

Once short-term stability was achieved, the focus shifted to long-term planning. Advanced machine learning and AI models were introduced to forecast demand variability 3 to 12 months ahead—enabling long-term investments that are typically difficult to predict.

This allowed Rappi to:

plan capacity and incentives in advance

reduce volatility risk

support sustainable, year-over-year growth

Phase 4: Process Optimization and Long-Term Value Capture

The forecasting system became a core input for multiple strategic initiatives, including:

payments

marketing investments

non-monetary incentives

strategic partnerships

The model was also implemented in the 2025 Rappi–Amazon alliance, ensuring investment decisions were aligned across short- and long-term horizons.

The expected annual impact exceeds $60M in value capture.

The results

Across high-variability days over the last four years:

+11.3% YoY sales growth during seasonal demand peaks

−22% reduction in delays caused by supply shortages

Lower operational costs through improved capital allocation

End-to-end process fully embedded into daily operations

Rappi transitioned to a replicable, scalable investment planning system that saves millions annually while enabling controlled growth.

Lessons learned

High demand is predictable: With the right data and models, volatility can be anticipated and managed.

Data must be operationalized: Analytics only create value when embedded into real business processes.

Long-term planning pays off: Strategic investments perform significantly better when informed by scenario-based forecasting.

Strong data systems enable partnerships: Reliable short- and long-term data unlocks strategic alliances, such as the Amazon partnership.

Key takeaways

Rappi demonstrates how investing in data systems and structured planning processes enables companies to scale efficiently across hundreds of cities.

Once implemented, this approach is:

repeatable

scalable

and capable of delivering value across both short- and long-term horizons

The key is not just building models—but designing systems that turn data into better investment decisions at scale.

The results

Across high-variability days over the last four years:

+11.3% YoY sales growth during seasonal demand peaks

−22% reduction in delays caused by supply shortages

Lower operational costs through improved capital allocation

End-to-end process fully embedded into daily operations

Rappi transitioned to a replicable, scalable investment planning system that saves millions annually while enabling controlled growth.

Lessons learned

High demand is predictable: With the right data and models, volatility can be anticipated and managed.

Data must be operationalized: Analytics only create value when embedded into real business processes.

Long-term planning pays off: Strategic investments perform significantly better when informed by scenario-based forecasting.

Strong data systems enable partnerships: Reliable short- and long-term data unlocks strategic alliances, such as the Amazon partnership.

Key takeaways

Rappi demonstrates how investing in data systems and structured planning processes enables companies to scale efficiently across hundreds of cities.

Once implemented, this approach is:

repeatable

scalable

and capable of delivering value across both short- and long-term horizons

The key is not just building models—but designing systems that turn data into better investment decisions at scale.

The results

Across high-variability days over the last four years:

+11.3% YoY sales growth during seasonal demand peaks

−22% reduction in delays caused by supply shortages

Lower operational costs through improved capital allocation

End-to-end process fully embedded into daily operations

Rappi transitioned to a replicable, scalable investment planning system that saves millions annually while enabling controlled growth.

Lessons learned

High demand is predictable: With the right data and models, volatility can be anticipated and managed.

Data must be operationalized: Analytics only create value when embedded into real business processes.

Long-term planning pays off: Strategic investments perform significantly better when informed by scenario-based forecasting.

Strong data systems enable partnerships: Reliable short- and long-term data unlocks strategic alliances, such as the Amazon partnership.

Key takeaways

Rappi demonstrates how investing in data systems and structured planning processes enables companies to scale efficiently across hundreds of cities.

Once implemented, this approach is:

repeatable

scalable

and capable of delivering value across both short- and long-term horizons

The key is not just building models—but designing systems that turn data into better investment decisions at scale.

When should you contact me? If you’re ready to use data to improve how your business is planned, built, operated, and scaled.

When should you contact me? If you’re ready to use data to improve how your business is planned, built, operated, and scaled.

When should you contact me? If you’re ready to use data to improve how your business is planned, built, operated, and scaled.